What's my borrowing capacity

Buying or investing in. You can borrow up to 830000.

Realtor Thanksgiving Kellerwilliams Homeownerhip Thanksfulforlist Benefitsofhomeownership Home Ownership The Borrowers Home Selling Tips

Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and.

. So you might need to put on that sports car for another few years while you focus so dont take out big novated leases or. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Your borrowing power will vary between banks and lenders.

Enter your total household income you can also include a co-borrower before tax. The borrowing capacity also called debt capacity is the. For example if you have a 5000 credit card limit and you owe 1000 on that card the math for.

Borrowing capacity or creditworthiness is the maximum. This ratio takes your annual housing. View your borrowing capacity and estimated home loan repayments.

Lenders commonly discuss borrowing capacity with client but that does not mean it is your max or what you would like. Each lender has various. Typically the greater the risk ie less likely to pay.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. If you need any assistance with this Id be.

Beranda 28 borrowing capacity Images. Credit history employment history. Compare home buying options today.

View your borrowing capacity and estimated home loan repayments. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and.

There are seven major reasons that will influence how much you can borrow. Estimate how much you can borrow for your home loan using our borrowing power calculator. Whats my borrowing capacity.

The lender uses your age income expenses existing debts job status dependents deposit size and other factors to consider your risk level. With rates constantly changing every month some people might be really confused as to what their borrowing capacity is in this market. Calculate your borrowing capacity using this borrowing capacity calculator from My Logan Realty.

It is a main component to determine the type. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. The Bank of Spain advises that the.

Your borrowing power will vary between banks and lenders. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Whats my borrowing capacity.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. What determines your borrowing capacity and what factors influence how much you can borrow. Standard borrowing capacity is between.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. Factors that contribute into the borrowing power calculation.

Say you have a deposit of 50000 this would get you a home loan of 250000. The other thing with expenses is personal debts. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your.

In most cases income from. This ratio takes your annual housing. A mortgage broker can find out your max because they have the.

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Pin By Bekah C On Learning Fun Subtraction With Borrowing Story Problems Fraction Bars

Where Art Thou Plot Of Dirt Residential Land Commune The Borrowers

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

Credit Card Payoff Calculator Credit Card Debt Paying Off Ideas Of Credit Card Debt Pa Credit Card Payoff Plan Paying Off Credit Cards Credit Card Interest

Lvr Borrowing Capacity Calculator Interest Co Nz

Lionel University Fitness And Nutrition Education Strength Training Fitness Fitness Goals

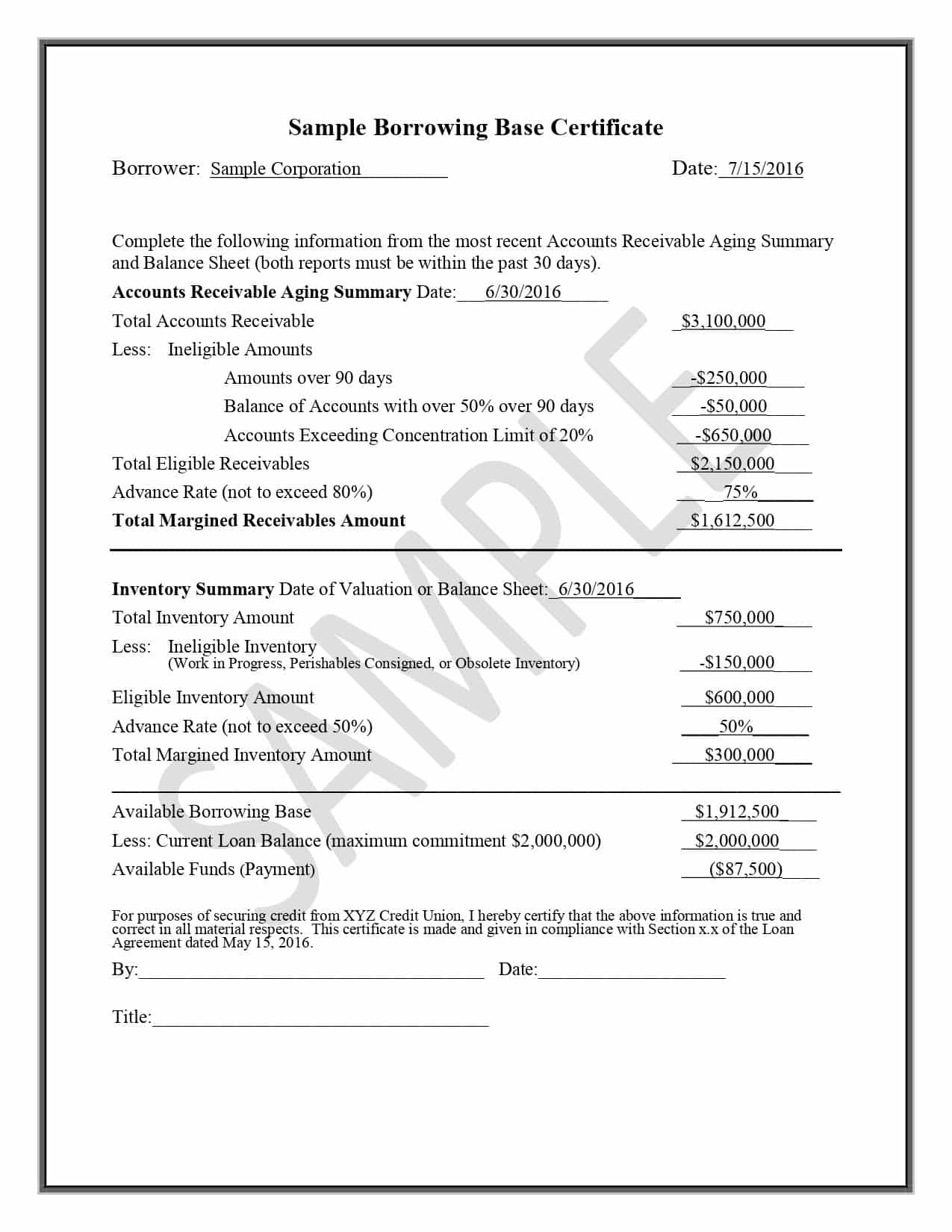

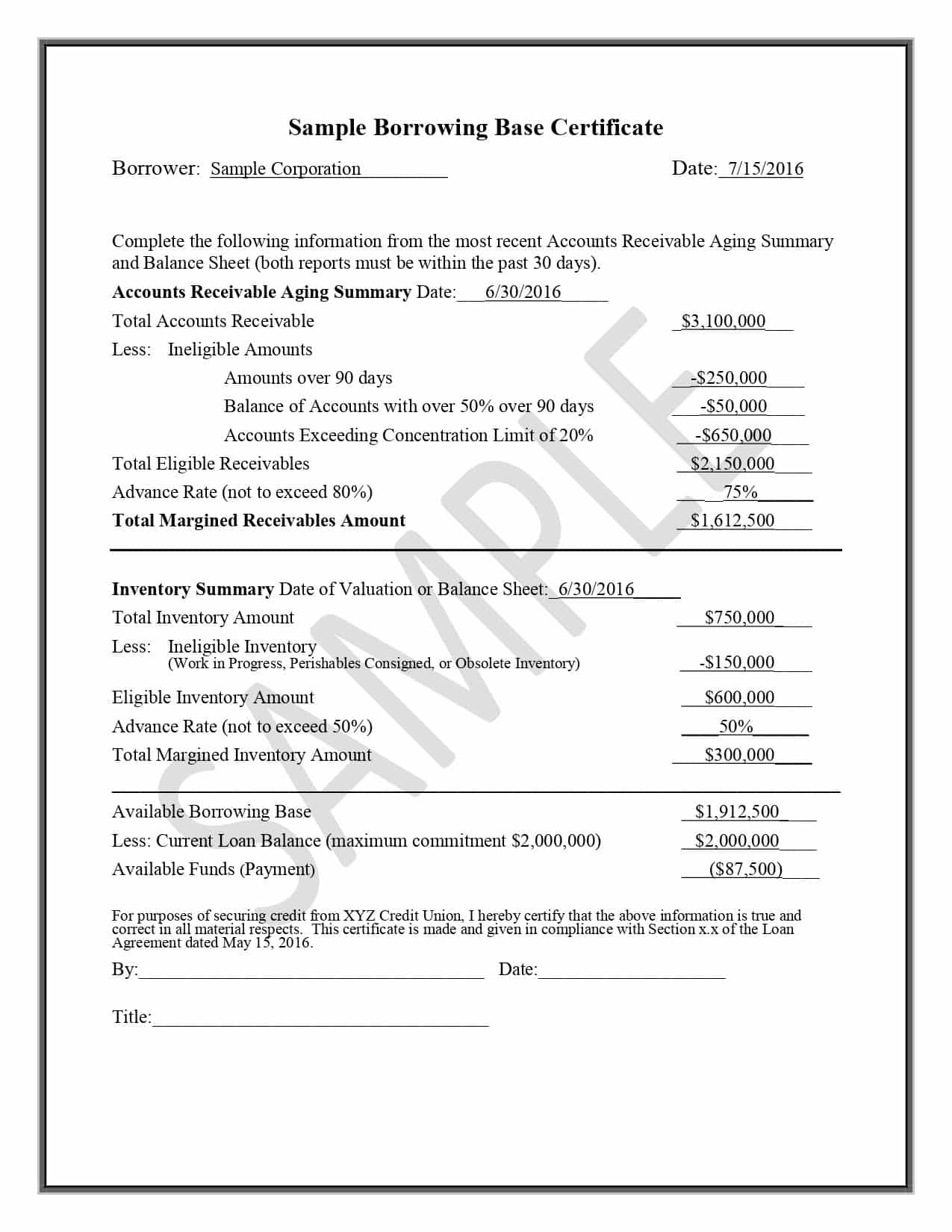

Borrowing Base What It Is How To Calculate It

How Much Can I Borrow Home Loan Calculator

Pin On Real Estate Happenings

Loan Calculator Credit Karma

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

Borrowing Power Calculator Sente Mortgage

7 Basics Of Financial Success Forum Credit Union Http Www Forumcu Com Saving Money Chart Financial Tips Money Management

Borrowing Base What It Is How To Calculate It

General Surety Bonds Information Infographic Party Fail Commercial Insurance

How Much Can I Borrow Home Loan Calculator